ATTENTION: serious investors

Wall Street Scrambles as Amazon's Latest Move Sends Quantum Stocks Soaring Up to 48%

Why Wall Street's Elite Are Quietly Stockpiling Quantum Computing Stocks As Major Breakthroughs Emerge

Breaking News Signals Major Shift

In the past 24 hours, two significant developments have shaken the quantum computing landscape. Amazon Web Services launched its Quantum Embark Program, sending quantum computing stocks soaring up to 48%. Simultaneously, the Barcelona Deep Tech Summit revealed quantum computing's transformation of the $2.5 trillion smart city market, demonstrating real-world applications previously thought years away.

Market Impact Already Visible

Quantum Computing (NASDAQ:QUBT): Up 28%

D-Wave Quantum (NYSE:QBTS): Up 48%

Multiple related tech stocks showing significant movement

Institutional investors rapidly increasing positions

Beyond Theory: Real-World Applications Emerging

Recent implementations are showing remarkable results:

Japan's traffic systems achieving 40% congestion reduction

UPS saving $400 million annually with quantum-inspired routing

Smart city grids optimizing energy distribution

Water management systems reaching unprecedented efficiency levels

The $46 Trillion Opportunity

McKinsey & Company projects quantum computing will reshape multiple trillion-dollar industries:

Healthcare and drug development ($1.5T)

Financial services ($25T)

Global logistics ($10.4T)

Energy and resources ($5T)

Agricultural optimization ($5T)

Smart Cities ($2.5T)

Why This Time Is Different

Unlike previous tech revolutions, quantum computing's adoption rate is accelerating faster than expected. AWS's Quantum Embark Program signals we're moving from research to implementation phase. As noted in their announcement, quantum computing "has the potential to revolutionize industries by solving problems that are beyond the ability of even the most powerful classical computers."

The Technology Gap

Current supercomputers might take 10,000 years to solve complex problems that quantum systems can process in minutes. This isn't incremental improvement – it's a fundamental shift in computing capability. One small Maryland-based firm has achieved a crucial breakthrough: quantum systems operating at room temperature, potentially accelerating mass adoption.

A tiny Maryland company's game-changing technology just won them a multimillion-dollar contract with a branch of United States Department of Defense.

No, it's not AI.

This technology is far greater... and far more disruptive.

In fact, Bank of America calls it:

"Bigger than fire and bigger than all the revolutions that humanity has seen."

And now that the U.S. government is going "all in..."

I believe this could create more millionaires than any other tech in history.

I've put together a full presentation to explain what's going on. But when news of this magnitude breaks, there's only a short window to capitalize.

Louis Navellier

Senior Quantitative Investment Analyst, InvestorPlace

Investment Implications

Early investors in transformative technologies have historically seen remarkable returns:

Amazon: 169,283% returns

Apple: 88,655% returns

Microsoft: Early investors saw similar gains

However, today's quantum computing sector is moving faster than previous tech revolutions. The window between early adoption and mainstream implementation is shrinking rapidly.

Risk Factors to Consider

While the opportunity is significant, not all companies claiming quantum capabilities will succeed. Key factors for investors to consider:

Technical capabilities and patents

Commercial partnerships

Government contracts

Research and development progress

Management team expertise

The Next 24 Months Are Critical

Industry experts suggest we're approaching a tipping point. As quantum physicist Alexandre Cooper-Roy stated at the Barcelona Summit, "Quantum computing has the power to revolutionize the way we manage our cities." This transformation is happening now, not in some distant future.

The Window Is Closing

For retail investors, the opportunity to position themselves ahead of mass adoption is narrowing. While mainstream media remains focused elsewhere, institutional investors are building significant positions in key quantum computing companies.

Final Thoughts

The convergence of AWS's announcement and the Barcelona Summit revelations demonstrates we're at a critical juncture. With quantum stocks showing significant movement on positive news, the market is beginning to recognize this shift. For investors looking to position themselves ahead of this technological revolution, understanding the key players and technologies is essential.

Editor's Note: The quantum computing sector is moving rapidly, with significant developments occurring daily. For investors seeking to understand the specific opportunities in this emerging market, we recommend watching the special presentation below from a leading Wall Street analyst who has tracked technology trends for over four decades and has identified key players positioned to dominate this transformative technology.

did this article make sense? If So...

Then You Need To Click Below...

Don't let AI hype distract you.

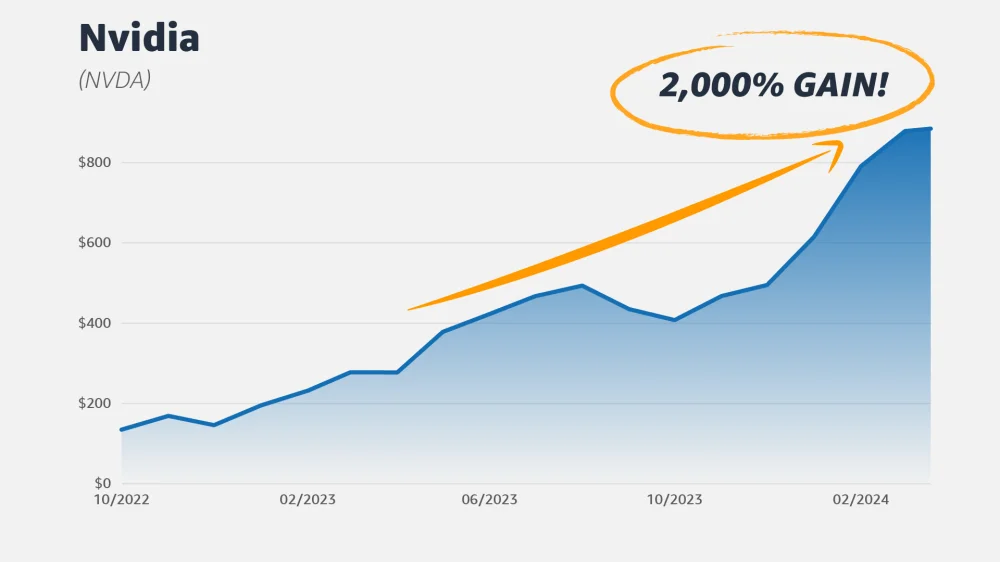

Even though Nvidia soared 2,000% in just a few years…

Jeff Bezos has loaded up on a tiny company being called

This company's technology is so revolutionary, it could show you big gains in the months ahead and disrupt a $46 trillion market.

And the same situation that sent Nvidia soaring to a $1 trillion valuation...

Could launch this stock on the same track to industry dominance.

But millions of Americans are in the dark.

That's why I've put together an urgent briefing to bring you the full story.

Louis Navellier

Senior Quantitative Investment Analyst, InvestorPlace

Trending Stories

|

|

MarketMoversPlaybook.com.com Disclaimer

MarketMoversPlaybook.com.com is a brand under Market Insiders Media dba, which is under the parent company Sandpiper Marketing Group, LLC. MarketMoversPlaybook.com.com is not registered as an investment adviser or broker-dealer with the United States Securities and Exchange Commission or any state regulating agency. Rather, MarketMoversPlaybook.com.com relies upon the "publisher's exclusion" from the definition of investment adviser as set forth in Section 202(a)(11) of the Investment Advisers Act of 1940, as amended, and corresponding state securities laws. As such, MarketMoversPlaybook.com.com does not offer or provide personalized investment advice. This report offers impersonal investment-related information to subscribers and/or prospective subscribers. The information we publish is based on our opinions plus our statistical and financial data and independent research of public information. Material provided by MarketMoversPlaybook.com.com is for informational purposes only, and no mention of a particular security in any of our materials constitutes a recommendation to buy, sell, or hold that or any other security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. To the extent that any of the information obtained from MarketMoversPlaybook.com.com may be deemed to be investment opinion, such information is impersonal and not tailored to the investment needs of any specific person. MarketMoversPlaybook.com.com does not promise, guarantee or in any manner imply that any information provided through our websites, newsletters, or reports, in any printed material, or displayed on any of our websites, will result in a profit or loss. Before investing in penny stocks, we encourage you to get personal advice from your professional investment, tax, or legal advisor(s) and to perform your own due diligence and independent investigations before acting on any information that we publish or making any investment decision. Only you and your professional advisors can determine what level of risk is appropriate for you. Penny stocks are an inherently speculative investment, and you should not invest in penny stocks unless you are prepared to lose your entire investment. Employees, owners, and/or writers of MarketMoversPlaybook.com.com may own positions in the equities, options, and/or securities mentioned in our reports, newsletters, and websites. However, no associated employees will intentionally engage in any transaction that directly or indirectly competes with the interests of our subscribers. MarketMoversPlaybook.com.com may be compensated for publishing information about companies referred to in our reports, newsletters, and websites, however, we will provide full disclosure.