ATTENTION: ACTIVE INVESTORS

Market Metrics & Moves

Issue: "Value Momentum: Top 3 Financially Strong Under-$50 Stock Profiles"

TRENDING NOW

|

Editor's Note: As the high-stakes February 26 earnings report approaches, market watchers are focused intently on Nvidia's trajectory. The company's historic rise to a $3 trillion valuation has set unprecedented expectations. Key focus areas include AI chip demand sustainability, data center spending trends, and potential regulatory headwinds. Our analysis indicates this earnings release could significantly impact the broader AI and semiconductor sectors. css CopyA trusted partner has just released time-sensitive research that I believe warrants your immediate attention. Nvidia's "Silent Partners" have Feb. 26 circled in redNvidia's Next Big Move Comes on Feb. 26 Inside the crucial data that could reshape tech investing in 2025. |

1 ZAI LAB LIMITED (ZLAB) - Reports Feb 27, Before Market

Chinese biopharmaceutical company focused on cancer and autoimmune disease treatments, showing strong momentum with 65% yearly gain. Trading at $33.91, the company has established a significant presence in the Chinese healthcare market. Analysts maintain unanimous buy ratings with average price target of $47.80, suggesting 41% upside potential despite current market volatility.

Key Metrics:

• Market Cap: $3.80B

• PE Ratio: -12.11

• YTD Change: 28.11%

• Revenue: $355.75M

• Operating Income: -$327.57M

• Net Income: -$270.85M

This presentation just crossed my desk from one of our most trusted partners, and I have to say - it's a must-watch.

Why the World's Largest AI Company Could Unleash Pandemonium...

In the Stock Market, and Throw Trump's Second Term into Utter Chaos...

All ahead of May 21st, 2024.

These aren't normal business moves we normally see from Big Tech...

They're emergency measures.

And I suspect it's because they know what's coming next.

A critical flaw in the AI revolution...

One that could throw Trump's entire tech agenda into chaos.

The mainstream media still hasn't connected the dots...

But Wall Street insiders have already started positioning themselves.

2 CARDIFF ONCOLOGY INC (CRDF) - Reports Feb 27, After Market

Clinical-stage biotech company developing cancer treatments with focus on onvansertib. Stock has surged 147% over past year with analysts projecting 160% upside to $11 target. Recent positive trial data and strong institutional backing have driven momentum, though pre-revenue status presents development risks.

Key Metrics:

• Market Cap: $281.37M

• PE Ratio: -4.45

• YTD Change: -2.53%

• Revenue: $689K

• Operating Income: -$46.41M

• Net Income: -$43.01M

3 BARFRESH FOOD GROUP INC (BRFH) - Reports Feb 27, After Market

Ready-to-blend beverage manufacturer targeting restaurant chains, showing impressive 245% yearly gain. Small-cap growth story with expanding distribution network and strong revenue trajectory. Limited analyst coverage but positive ratings suggest 30% upside potential, though small market cap makes stock volatile.

Key Metrics:

• Market Cap: $63.87M

• PE Ratio: -22.44

• YTD Change: N/A

• Revenue: $9.85M

• Operating Income: -$2.66M

• Net Income: -$2.67M

looking for opportunities?

YOU NEED TO CLICK BELOW...

|

Nvidia's Next Big Move Comes on Feb. 26 Nvidia's "Silent Partners" have Feb. 26 circled in red Nvidia continues to lead the pack when it comes to AI… Following a year when the AI chip giant became just the third company ever with a market cap greater than $3 trillion… There are no signs of slowing down in 2025. Wednesday, Feb. 26 is the next key date for Nvidia. That is when its latest quarterly earnings call takes place. And get this, the last time Nvidia had this call, in November… It announced year-over-year gains in one key AI sector of 112%. Now, with Nvidia already dominating AI's newest frontier ... A move that was recently valued at more than $1 trillion… The Feb. 26 call could skyrocket Nvidia's stock even further. And Nvidia isn't the only company eagerly awaiting this call… You see, companies partnering with Nvidia on this AI journey have already seen their own stocks soar.

Companies like ASML, up as much as 500%…

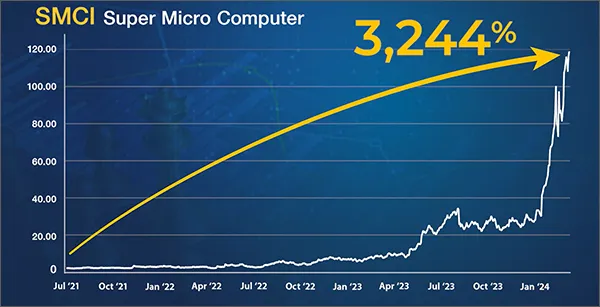

SMCI, up as much as 3,244%…

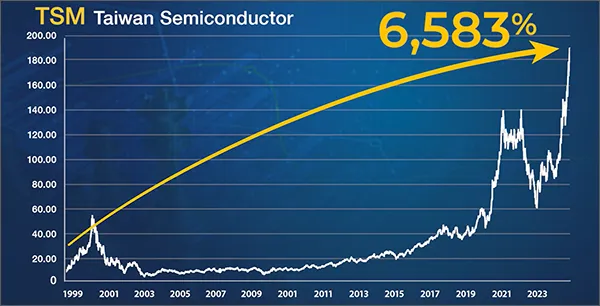

And TSM, up as much as 6,583%. Now, with Nvidia's recent move to this $1 trillion Superproject… On Feb. 26, a small handful of Nvidia's other partners could see their own stocks surge upward. |