ATTENTION: serious investors

AI-Powered Trading: Why 2025 Could Be Too Late to Join the Revolution

Wall Street's $15.33 billion AI trading boom is creating a new class of winners - and everyday investors who wait until 2025 risk missing the biggest gains"

The stock market is undergoing its most significant transformation since the introduction of electronic trading. With artificial intelligence projected to grow at a staggering 36.6% compound annual rate through 2030, a new breed of trading technology is emerging that could make traditional stock picking obsolete.

The numbers are compelling:

The algorithmic trading market is expanding by $15.33 billion through 2028

AI-powered trading systems are achieving success rates above 80%

Major institutions are investing billions in this technology

Market leaders using AI have seen returns exceeding 1,000% in months, not years

Looking at NVIDIA, the premier AI chip manufacturer, provides a glimpse of this transformation's scale. The company's 29,031% return over the past decade demonstrates the explosive potential when artificial intelligence meets market opportunities. But according to market experts, we're still in the early stages.

What's driving this revolution?

A sophisticated combination of:

Machine learning algorithms processing millions of data points per second

Real-time sentiment analysis of news and social media

Post-earnings pattern recognition that human traders often miss

High-frequency trading capabilities that capitalize on microsecond opportunities

The Power of Post-Earnings Momentum

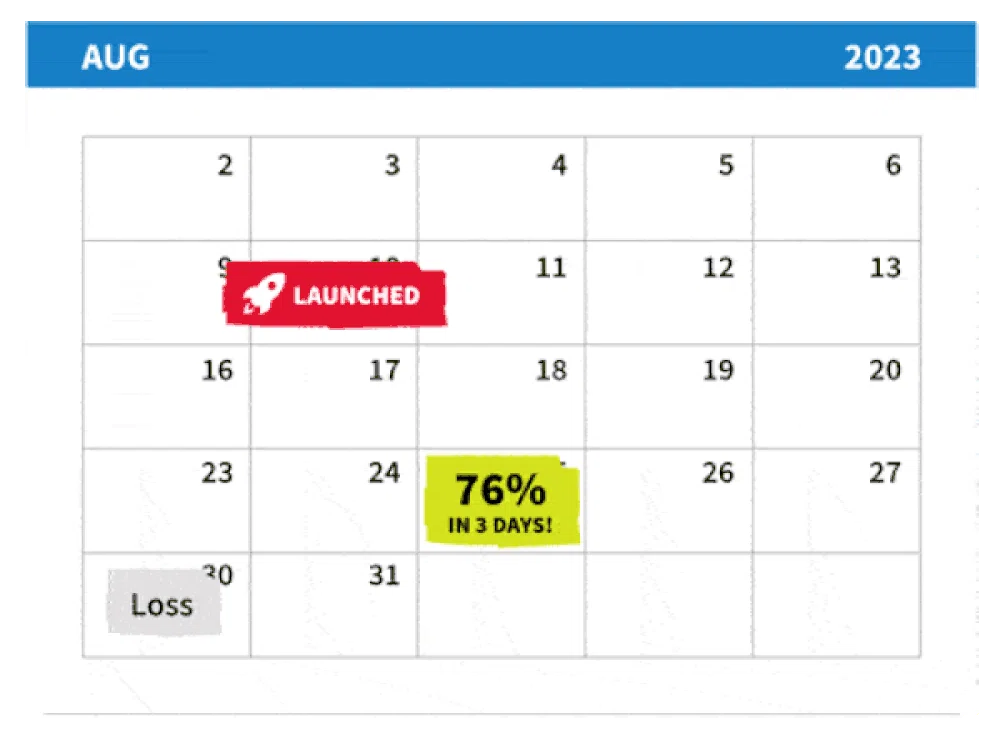

While most retail investors focus on predicting earnings announcements - a notoriously risky strategy - AI systems have identified a more reliable approach. By analyzing post-earnings patterns, these systems can identify stocks likely to continue their upward trajectory after positive announcements.

This strategy has been validated by research from Harvard, Duke, and even the Federal Reserve. More importantly, retail traders using these AI-powered systems have reported consistent profits, with some achieving returns that dwarf the market's average 10% annual gain.

Why Traditional Trading Is Becoming Obsolete

Traditional stock analysis faces several limitations that AI easily overcomes:

Human analysts can only process a fraction of available market data

Emotional biases affect decision-making

Manual analysis is too slow for today's market speed

Pattern recognition is limited by human cognitive capabilities

The AI Advantage

Modern AI trading systems offer several critical advantages:

Analysis of millions of data points in milliseconds

Elimination of emotional trading decisions

Real-time adaptation to market conditions

Integration of multiple data sources for more accurate predictions

An everyday man who famously turned $37k into $2.7 Million in just 4 years and became one of the most followed trading experts...

Is revealing a powerful new AI tool that is helping him find MORE explosive trade setups faster than ever...

All using a simple strategy that beat the market by 17x in Q1.

See how it works BEFORE the next profit opportunity on Monday @ 12pm EST. Click to read more >>

The Technology Gap

While major institutions have been developing these capabilities for years, retail investors have largely been left behind. However, new platforms are emerging that give individual traders access to institutional-grade AI trading technology.

These systems can:

Scan the entire market in seconds

Identify high-probability trade setups

Execute trades at optimal moments

Manage risk automatically

The Window of Opportunity

As we approach 2025, the adoption of AI trading technology is accelerating. The market has already seen the impact with companies like NVIDIA, whose stock has risen over 837% since 2023 alone. This trend suggests that traders who adopt AI technology early will have a significant advantage over those who wait.

Looking Forward

Industry projections suggest that by 2025, AI will be fundamental to most trading operations. Early adopters of this technology are positioning themselves to capitalize on what could be the most significant shift in trading methodology since the introduction of electronic markets.

The Time to Act Is Now

For investors seeking to stay ahead of this transformation, waiting until 2025 could mean missing out on the most significant gains. As more traders adopt AI technology, the advantage gap between AI-powered and traditional trading approaches will likely widen.

There is an exclusive presentation below that you might be very interested in watching that will help you learn on how you can harness the power of AI-driven trading technology today, and position yourself to potentially capture gains that most investors won't see in their lifetime.

Don't wait until AI trading becomes mainstream.

did this article make sense? If So...

Then You Need To Click Below...

A cutting-edge AI trading tool just detected a brand-new "Profit Surge" that could help everyday Americans collect huge windfalls in a matter of days or even hours.

This powerful market force which has been quietly studied by Harvard, the US Federal Reserve and the Securities Exchange Commission...

Has given investors the opportunity to beat the market by 1,700% and a 100% win rate to begin the year.

The next opportunity to cash-in on the next profit surge is on Monday.

See how it works before the next big move:

Trending Stories

|

|

MarketMoversPlaybook.com.com Disclaimer

MarketMoversPlaybook.com.com is a brand under Market Insiders Media dba, which is under the parent company Sandpiper Marketing Group, LLC. MarketMoversPlaybook.com.com is not registered as an investment adviser or broker-dealer with the United States Securities and Exchange Commission or any state regulating agency. Rather, MarketMoversPlaybook.com.com relies upon the "publisher's exclusion" from the definition of investment adviser as set forth in Section 202(a)(11) of the Investment Advisers Act of 1940, as amended, and corresponding state securities laws. As such, MarketMoversPlaybook.com.com does not offer or provide personalized investment advice. This report offers impersonal investment-related information to subscribers and/or prospective subscribers. The information we publish is based on our opinions plus our statistical and financial data and independent research of public information. Material provided by MarketMoversPlaybook.com.com is for informational purposes only, and no mention of a particular security in any of our materials constitutes a recommendation to buy, sell, or hold that or any other security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. To the extent that any of the information obtained from MarketMoversPlaybook.com.com may be deemed to be investment opinion, such information is impersonal and not tailored to the investment needs of any specific person. MarketMoversPlaybook.com.com does not promise, guarantee or in any manner imply that any information provided through our websites, newsletters, or reports, in any printed material, or displayed on any of our websites, will result in a profit or loss. Before investing in penny stocks, we encourage you to get personal advice from your professional investment, tax, or legal advisor(s) and to perform your own due diligence and independent investigations before acting on any information that we publish or making any investment decision. Only you and your professional advisors can determine what level of risk is appropriate for you. Penny stocks are an inherently speculative investment, and you should not invest in penny stocks unless you are prepared to lose your entire investment. Employees, owners, and/or writers of MarketMoversPlaybook.com.com may own positions in the equities, options, and/or securities mentioned in our reports, newsletters, and websites. However, no associated employees will intentionally engage in any transaction that directly or indirectly competes with the interests of our subscribers. MarketMoversPlaybook.com.com may be compensated for publishing information about companies referred to in our reports, newsletters, and websites, however, we will provide full disclosure.